U.S. Cotton Demand and Stock Estimates Revised.

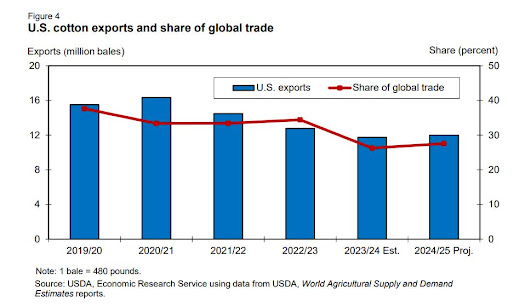

U.S. cotton demand (mill use plus exports) and stocks for 2024/25 and 2023/24 were adjusted in August based on the latest available data. U.S. exports for 2024/25 are forecast at 12.0 million bales, 1.0 million below the July projection but slightly above the previous year (figure 4). The lower forecast is attributable to the reduced crop estimate this month as well as decreased import prospects from China, a major destination for U.S. cotton. U.S. cotton mill use is projected at 1.9 million bales in 2024/25, unchanged from July but slightly above last year. The U.S. export estimate for 2023/24 was increased this month to 11.75 million bales, the lowest since the 2015/16 shipments of 9.2 million bales. Complete data for 2023/24 U.S. cotton exports will be available in September. Estimated U.S. cotton mill use remains at 1.85 million bales in 2023/24. The United States is expected to be the second largest cotton exporter to the world in 2024/25. Lower U.S. production, associated with drought conditions in recent years, helped promote Brazil as the top exporter in 2023/24 and the export competitiveness is expected to continue this season. The U.S. share of global trade is projected at 28 percent for 2024/25, compared with 26 percent the year before. U.S. cotton exports are forecast to account for 86 percent of U.S. cotton demand in 2024/25, similar to the previous season. With U.S. cotton production projected to exceed demand in 2024/25, ending stocks are expected to increase to 4.5 million bales, 43 percent above the beginning level and the highest in 5 years. The stocks-to-use ratio (32 percent) is projected at its largest since 2019/20. Along with the higher U.S. stocks, global cotton production is also expected to exceed demand in 2024/25 and supports this month’s lower U.S. price prospects. For 2024/25, the upland cotton farm price is forecast at 66 cents per pound, below an estimated 76 cents per pound in 2023/24.

Comments

Post a Comment