Global Cotton Trade Lower; Ending Stocks To Increase.

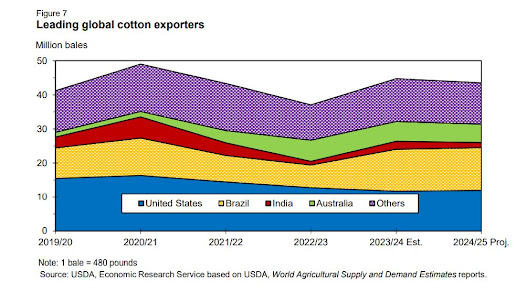

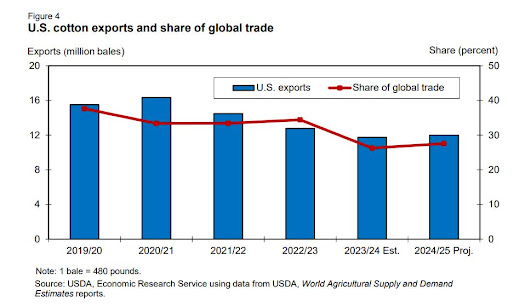

World cotton trade in 2024/25 is forecast at 43.5 million bales, compared with 44.7 million bales in 2023/24. With global cotton mill use projected to expand in 2024/25, most major importing countries—excluding China—are expected to experience higher imports as well. Global cotton imports are forecast only slightly higher at 43.6 million bales in 2024/25, as China is projected to reduce its imports considerably this season. China, Bangladesh, and Vietnam are projected to be the largest importers in 2024/25, with imports of 10.0 million bales (-4.8 million bales), 7.8 million bales (+500,000 bales), and 7.1 million bales (+400,000 bales), respectively. Small export gains are seen for several countries but larger decreases elsewhere more than offset the gains. Larger exportable supplies in Brazil and the United States this season contribute to their small gains, while India’s lower crop projection limits its cotton export opportunities. Brazil and the United States are expected to account for a combined 56 percent of global exports in 2024/25 (figure 7). Brazil became the leading cotton exporter last season when U.S. supplies were limited and is projected to remain the top exporter in 2024/25. Brazil is forecast to export a record 12.5 million bales (+200,000 bales) of cotton in 2024/25. Australia’s exports are projected at 5.4 million bales, modestly below last season as supplies are lower in 2024/25 despite an unchanged crop estimate. India’s cotton exports (1.5 million bales) in 2024/25 are projected 825,000 bales lower due to its smaller supplies. For Mali and Benin—the largest African Franc Zone exporters in 2024/25—exports are estimated at 1.3 million (+150,000 bales) and 1.0 million bales (-50,000 bales), respectively.

Global cotton ending stocks for 2024/25 are projected at 77.6 million bales, 1.8 million bales (2.4 percent) above last season and the highest since 2019/20. The 2024/25 global stock increase is led by the United States, Brazil, and Pakistan, where stocks are projected nearly 1.4 million bales, 900,000 bales, and 350,000 bales, respectively, above the year before. Partially offsetting these gains are lower stocks in China and India. In China, ending stocks are estimated at 37.1 million bales in 2024/25, down from last season but the second highest level since 2016/17. India’s stocks are projected 500,000 bales lower in 2024/25 at 10.1 million bales, the lowest in 3 years. Brazil’s stocks are estimated at 4.1 million bales at the end of 2024/25, an increase of nearly 29 percent year-over-year and the second highest on record as a record crop is anticipated. Cotton stocks in Pakistan are similarly expected to rise 21 percent to 2.0 million bales by the end of 2024/25. The 2024/25 global cotton stocks-to-use ratio is projected to remain flat for a third consecutive year despite rising stock levels. Forecast at 67 percent, the stocks-to-use ratio represents 8 months of mill use at the current global use estimate. Ending stocks as a share of world supplies by country vary from year-to-year depending on production and trade. Stocks for the top four producing countries combined are projected to account for about 72 percent of the global total, slightly above the 5-year average. China—the largest stockholder—is projected to hold approximately 48 percent of the global total in 2024/25, while India accounts for an additional 13 percent (figure 8). The United States and Brazil are forecast to hold about 6 percent and 5 percent, respectively, of the global cotton supplies at the end of 2024/25, up from last year but similar to 2022/23.

Comments

Post a Comment